USA

800 691 9120

UK

01225 704844

We use cookies on our website to analyze website usage and to help secure the website against misuse. Advertising and functional cookies are not used in our site or our web application products.

By clicking “Accept Essential Cookies Only”, you consent to us placing these cookies.

Depreciation allocates the cost of an asset over its useful life. Instead of taking the entire cost of the asset as a loss at the point of purchase, deprecation allows you to spread the cost over several years. This results in higher profit in the year of purchase, but also higher corporation tax.

In the UK, depreciation is not recognised for tax purposes, but is used for financial reporting under standards such as FRS 102 and IFRS. For tax purposes, we use Capital Allowances, which are explained below. Typically UK businesses will calculate depreciation for financial reporting, and calculate Capital Allowances in a separate accounting book.

The relevant frameworks are:

Capital allowances allow businesses to deduct the cost of capital assets, including IT equipment, from their taxable profits. This applies when purchasing, using, and disposing of assets. When an asset is sold or scrapped, a balancing charge or allowance may apply to adjust the total relief claimed. A balancing charge increases taxable profits if an asset is sold for more than its tax written-down value, while a balancing allowance provides relief if sold for less

There are three types of capital allowances relevant to IT assets:

A business purchasing £50,000 in IT equipment can claim the full amount under AIA, reducing taxable profits in the year of purchase. From 2019 to 2025 the annual AIA limit was £1,000,000 for qualifying expenditure.

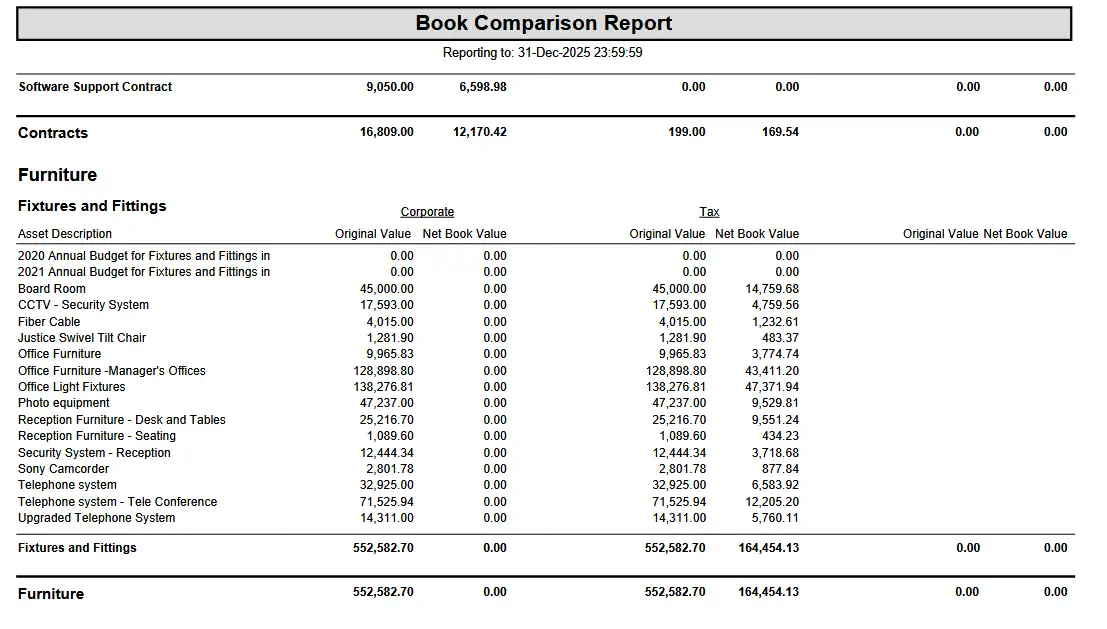

xAssets Fixed Asset Management Software tracks asset acquisition cost, depreciation, and disposal value, providing the reports and data needed to calculate capital allowances and these can be calculated for you into a separate accounting book, and can be viewed alongside corporate and GAAP reporting.

If you spend more than £1m on Capital Assets in one financial year, you can still claim allowances, but not under the AIA. For these assets you claim a writing down allowance. Some assets qualify for 100% writing down, others for 50% under a first year allowance.

The following documents help to understand capital allowances:

| Asset Category | Common Depreciation Methods | Typical Useful Life |

|---|---|---|

| Land | Not depreciated | N/A |

| Buildings | Straight-line | 20–50 years |

| Plant and Equipment | Straight-line or reducing balance | 5–15 years |

| Vehicles | Reducing balance or straight-line | 3–8 years |

| IT Equipment | Straight-line | 3–5 years |

| Leasehold Improvements | Straight-line over lease term | Varies |

Within the xAssets solution, depreciation rules operate default values at the Category level, and are assigned to individual assets when the assets are created. You can edit the default or deploy specific rules to specific assets, but for most customers it is sufficient to allow the rules to apply at Category level.

For example, a £10,000 server with a 5-year life would depreciate £2,000 annually under straight-line.

Straight-Line: Equal charge each year:

Reducing Balance: Fixed percentage applied to net book value:

Units of Production: Based on usage rather than time. The xAssets software can calculate depreciation for this rule with an API connection or a feed from any units of production data source.

The xAssets Depreciation Toolset includes the ability to create any depreciation formulae. Common depreciation scenarios such as Straight line, Declining Balance, SYD, Units of Production, GDS, MACRS and ACRS (US only), Mid Month, Half Year, Mid Quarter, are all supported "out of the box", and more formulae can be added if needed.

With IFRS, parts of an asset with different recovery periods (different useful lives) are depreciated separately. E.g. A building may be split into structure, air conditioning, and lifts all depreciated separately.

In real terms you simply store these as separate asset records with inter-asset relationships and each one carries the value to be depreciated for that component.

When an asset is disposed, we write off its remaining net book value, but we add or subtract the balances if the asset was sold and if there was a cost of sale.

| Aspect | IFRS / FRS 102 | HMRC Capital Allowances |

|---|---|---|

| Depreciation Basis | Accounting judgement | Prescribed allowances |

| Land | Not depreciated | Not eligible |

| Buildings | Depreciated over useful life | Structures allowance (3%) |

| Pooling | Not used | Integral features pooled |

| Revaluation | Permitted (IFRS) | Not recognised |

xAssets Fixed Asset Management Software supports UK and international depreciation standards, including:

This enables compliance with financial reporting and audit requirements for organisations with 200 to 100,000 assets.

Depreciation under UK accounting rules requires application of depreciation rules based on asset categories and standards. For compliance and audit readiness, fixed asset software solutions such as xAssets Fixed Asset Management Software ensure accuracy, transparency, tax compliance, and alignment with standards.

Free instances are free forever and can show demo data or your data.