USA

800 691 9120

UK

01225 704844

We use cookies on our website to analyze website usage and to help secure the website against misuse. Advertising and functional cookies are not used in our site or our web application products.

By clicking “Accept Essential Cookies Only”, you consent to us placing these cookies.

We meet most requirements "out of the box" allowing immediate benefits and excellent time to value.

Our platform provides rapid integration and configuration ensuring that complex requirements can be met quickly, providing a system exactly matched to your needs.

Enterprise implementations are often completed in a few days whereas leading competitors would take much longer to meet the same requirements. The "out of the box" configuration is often suitable for many organizations.

This strategic product sits at the center of your asset operations to ensure operational efficiency and financial visibility with instant access to asset information from anywhere.

The "out of the box" system fits most requirements allowing excellent time to value. Easy configurability extends the system to meet your exact needs.

Small configuration changes are done free of charge as part of your support subscription.

All editions include a comprehensive asset register with discovery and software reporting

| Number of Users | Number of Fixed Assets | Monthly US Dollar | Annual US Dollar |

|---|---|---|---|

| 1 | 1000 | Free | Free |

| 2 | 2000 | $39 | $468 |

| 5 | 5000 | $156 | $1,872 |

| 10 | 10000 | $351 | $4,212 |

| 50 | 50000 | $1,911 | $22,932 |

Free instances are free forever and can show demo data or your data.

Excellent software, excellent support

We implemented xAssets for our Fixed Asset and Stock Management in 2018, and have used it for over four years with great success. The software is in the cloud, so we did not need to install it. It works from our mobile phones and from PCs and apple macs, so we can use it from any location and when on the move. The system was configured to our needs which meant we only needed a handful of menus, and as a result we did not need training. The system is great for reporting, if I need a new report I can get that quickly without needing help and the way the system automatically builds a drilldown structure for each report I create is really cool.

Pros: Able to use it from any device, pricing is very reasonable and the support we get is fantastic. Depreciation calculation is quick and easy and it natively posts journals into our accounting system. The system is very fast even on a mobile and we really like the reporting features and charting plus the ability to find anything quickly.

Cons: Whenever we think of a feature that isn't there, the xAssets support guys either show us how to do it, or they go off and create it for us, couldn't ask for more!

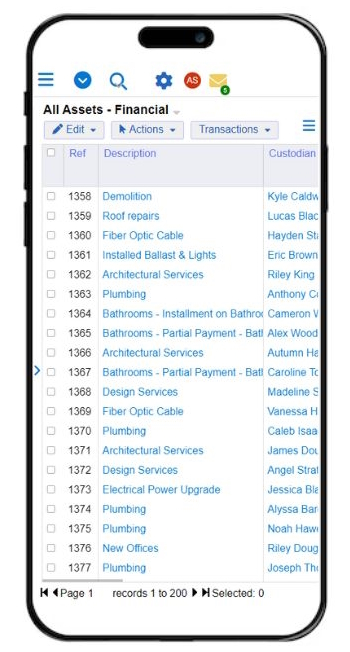

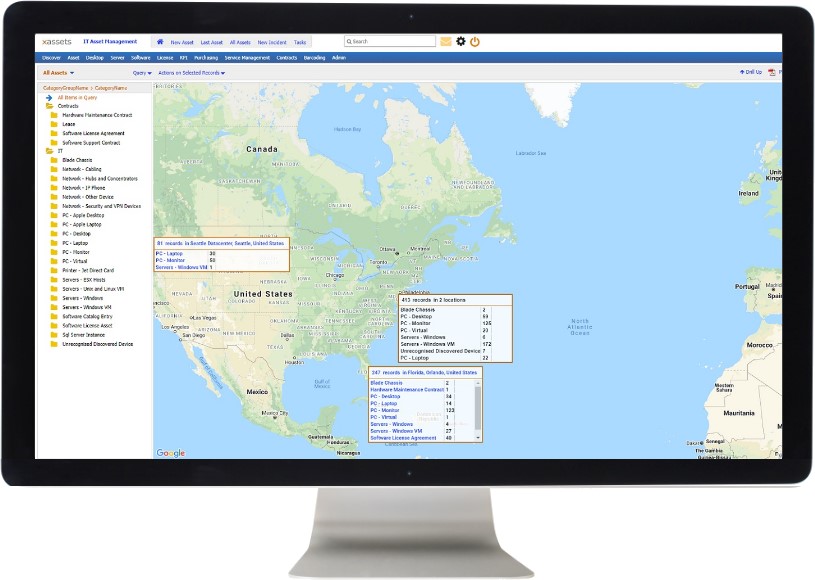

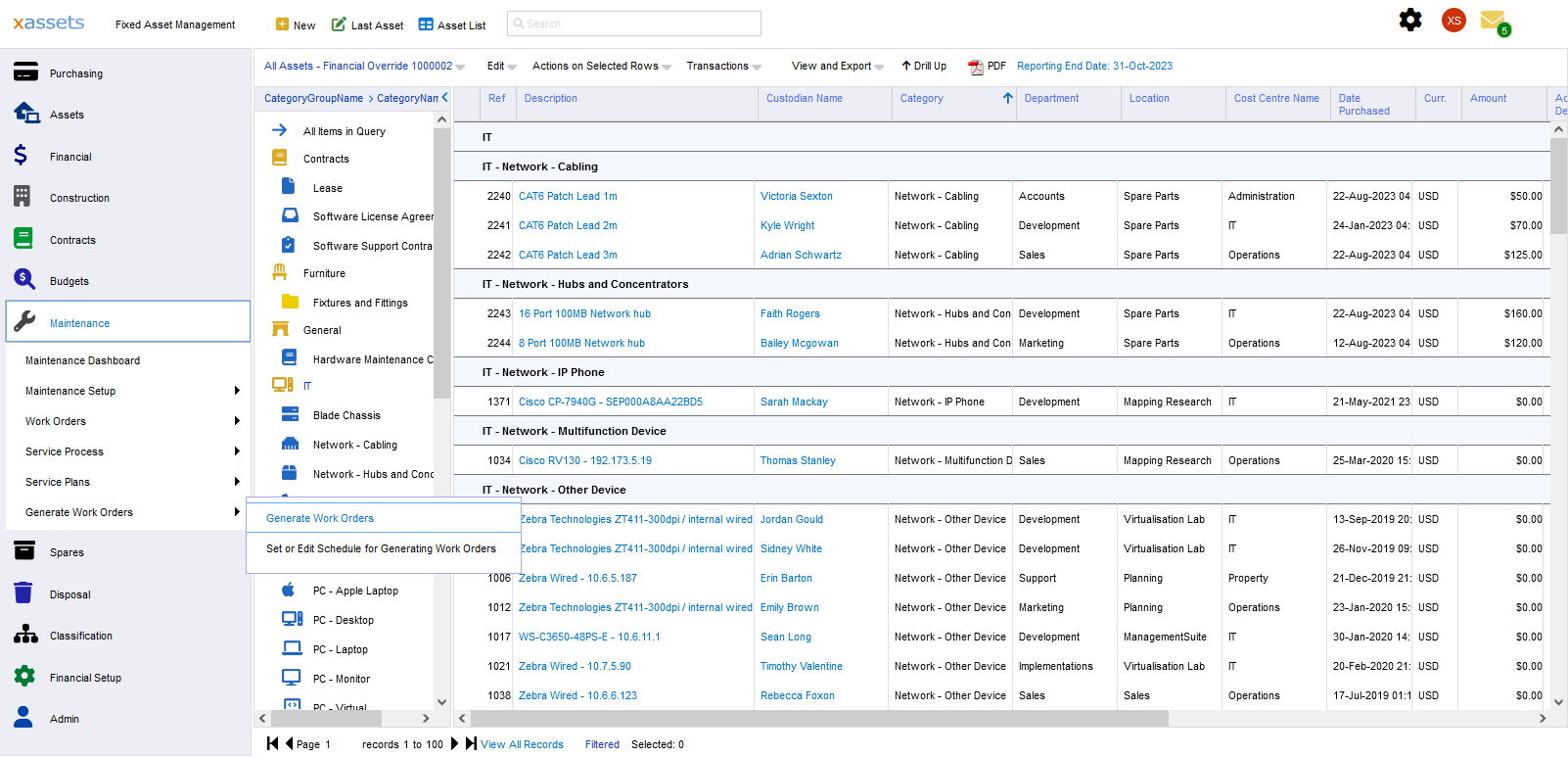

Powerful data visualization tools are provided to get answers fast.

Visualization includes tables, charts, reports, excel extracts and maps. Users can create queries and reports and make them part of the system. The user interface is fast and slick (sub-second response times) so users can search, drill up and drill down quickly to find the information required.

The financials engine offers flexibility to implement depreciation calculations based on any mathematical formula or computer program.

Well planned servicing and preventative maintenance are proven to be benefical in almost all business scenarios. xAssets supports a comprehensive planned maintenance and task scheduling system.

All solutions include pre-built integrations and standard imports are provided and loaders can be built for any data source.

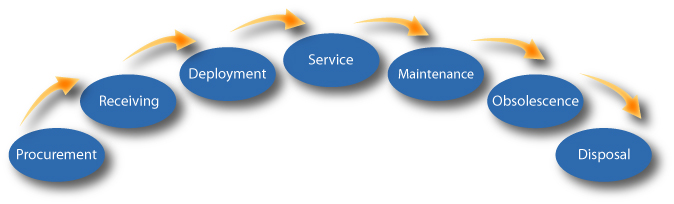

The optimal architecture to maximize ongoing benefits and achieve full utilisation:

Apps and other installed software can be costly to maintain, so xAssets solutions are browser based and can be used from any device without installation.

Our software uses a "Single Page Application" architecture. This means the screen is never refreshed completely, content only changes when needed. This makes the end user experience slick with fast response times.