USA

800 691 9120

UK

01225 704844

We use cookies on our website to analyze website usage and to help secure the website against misuse. Advertising and functional cookies are not used in our site or our web application products.

By clicking “Accept Essential Cookies Only”, you consent to us placing these cookies.

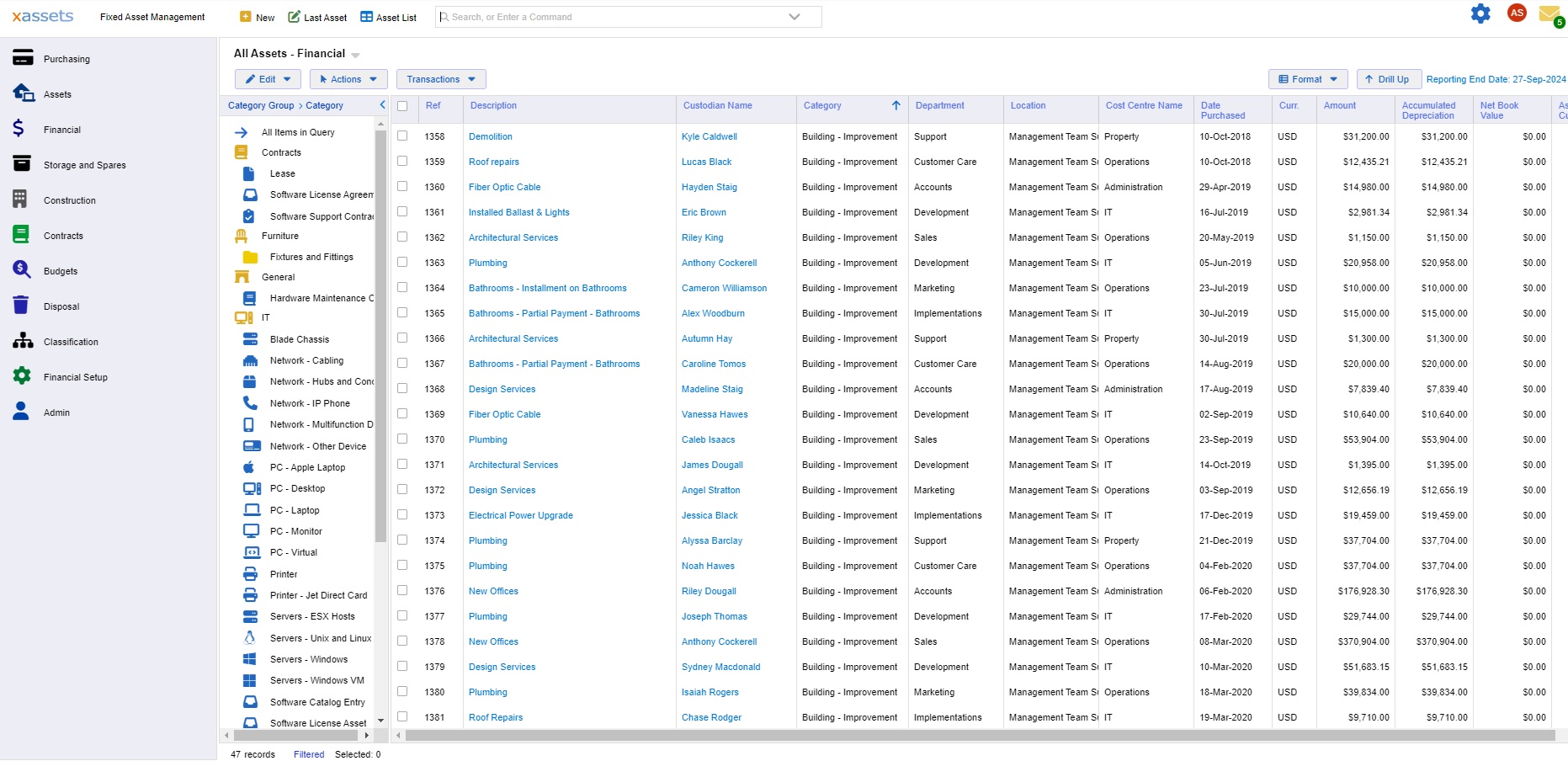

xAssets Fixed Asset Management Software implements depreciation calculation and period end processing as a simple and efficient process, and the month end process is based on a simple three step process:

Despite the simplicity of this process, the software is deeply configurable to be able to calculate any depreciation formulae. The system caters for multiple currencies, multiple companies, multiple books, and multiple depreciation formulae. Transfers and Disposals are correctly accounted for, and the system supports accounting for Construction in Progress (CIP). Catch-up depreciation is supported to allow for errors in previous periods to be corrected.

Depreciation calculations can be based on any mathematical formula or computer program.

In general, companies depreciate assets (and amortize leases) which are in service (or available for service). xAssets allows flexibility in defining when an asset is in service, and allows for assets to be in service for part of a period, e.g. based on the date in service or the date out of service (or date of disposal).

Multiple companies are supported. Companies with the same accounting periods can be depreciated together so groups of companies can be managed as if they were one company. Companies with different accounting periods can still be stored and reported together. Companies with different nominal code structures can be stored together and even depreciated together.

The system supports companies with unusual accounting periods. Accounting periods can be automatically generated or manually set up. Different companies can have different sets of accounting periods, or many companies can utilise the same set as required.

As well as standard monthly periods, 4-4-5 periods are also supported, and the system can allow for changed, or other financial year adjustments such as extended or shortened financial years.

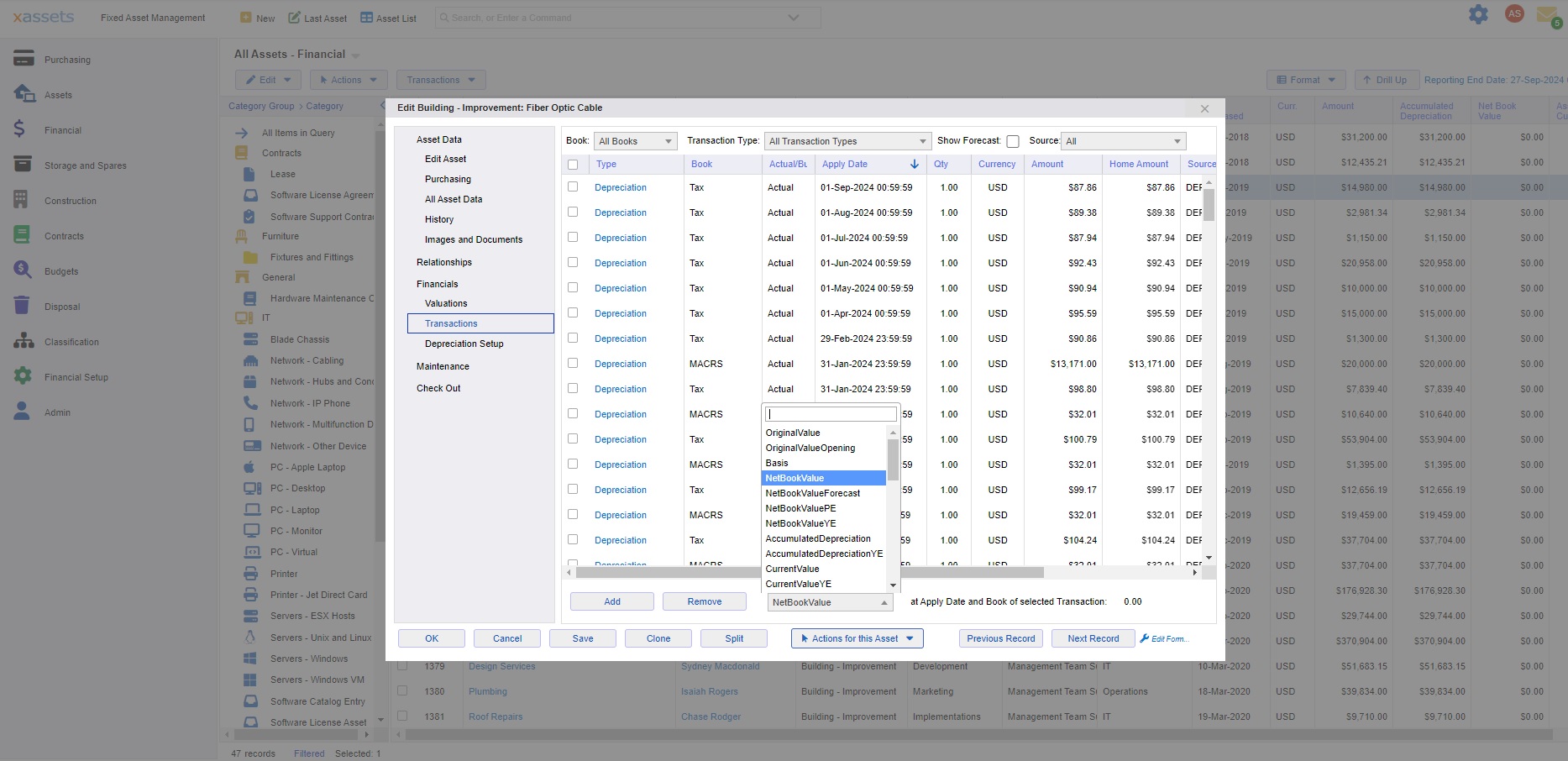

Depreciation support is comprehensive. Assets can belong to an unlimited number of books. Depreciation profiles can change over time (so for example you can calculate one formula such as double declining balance up to a certain date, then switch to another formula such as straight line) and you can specify which formulae or tables are used in depreciation calculations. The system exposes a number of "variables" for use in depreciation calculations. Indexation of assets is easy to set up and is defined per category group per financial year per currency.

xAssets Fixed Asset Management Software is also multi currency. True multi currency support is achieved by storing a currency code against every value stored in the system, so an asset can be purchased in Yen, Depreciated in Pounds and then Euros and then disposed of in US Dollars. Exchange rates are automatically downloaded from the web on a regular basis, and you can decide which exchange rates API service to use.

The depreciation engine is designed to work with any depreciation formulae, lookup tables or scenario including the most complex USA depreciation rules. Users can build, model and compare depreciation formulae to understand their effect.

The system include these formulae by default, but any formulae or depreciation table lookups (as done in MACRS and ACRS) can be configured into the system

| Depreciation Type | Sql Formula |

|---|---|

| Standard 20% Declining Balance |

0.2 * (NetBookValue - SalvageValue) * (DepreciableDaysInExistence / DaysInYear)

|

| No Depreciation | 0 |

| Straight Line over Recovery Period |

(OriginalValue - SalvageValue) / RecoveryPeriod

|

| Standard Depreciation at 25% per annum |

0.25 * OriginalValue * DepreciableDays / DaysInYear

|

| GDS Tables |

Lookup() * BusinessUseFactor * InServiceFlag * Basis / DepreciablePeriodsInServiceInYear

|

| GDS 200% DB Half Year Calculated |

2 * (PeriodsInFy / RecoveryPeriod) * HalfYearFactor * BusinessUseFactor * BasisDepreciated / DepreciablePeriodsInServiceInYear

|

| GDS 200% DB Mid Quarter Calculated |

2 * (PeriodsInFy / RecoveryPeriod) * MidQuarterFactor * BusinessUseFactor * BasisDepreciated / (DepreciablePeriodsInServiceInQuarter * 4)

|

| GDS 200% DB Mid Month Calculated |

2 * (PeriodsInFy / RecoveryPeriod) * MidMonthFactor * BusinessUseFactor * BasisDepreciated / DepreciablePeriodsInServiceInYear

|

| Straight Line Daily |

(DepreciableDaysInExistence / DaysInPeriod) * (OriginalValue - SalvageValue) / RecoveryPeriod

|

| Straight Line Daily In Service |

(DepreciableDaysInService / DaysInPeriod) * (OriginalValue - SalvageValue) / RecoveryPeriod

|

| Straight Line Half Year |

(PeriodsInFy / RecoveryPeriod) * HalfYearFactor * BusinessUseFactor * Basis / DepreciablePeriodsInServiceInYear

|

| Sum of Years Digits |

(OriginalValue - SalvageValue) * InServiceFlag * (RecoveryPeriod / 12 - YearsInService) / (12 * (RecoveryPeriod / 12) * ((RecoveryPeriod / 12) + 1) / 2)

|

| Straight Line Mid Quarter |

(PeriodsInFy / RecoveryPeriod) * MidQuarterFactor * BusinessUseFactor * Basis / (DepreciablePeriodsInServiceInQuarter * 4)

|

| Straight Line Whole Month |

(DepreciableDaysWholeMonth / DaysInPeriod) * BusinessUseFactor * Basis / RecoveryPeriod

|

| Straight Line Mid Month |

MidMonthFactor * BusinessUseFactor * Basis / RecoveryPeriod

|

| Lease Amorization - Straight Line |

Basis / RecoveryPeriod

|

| Whole Year Straight Line |

FirstPeriodInFYFlag * Basis * PeriodsInYear / (RecoveryPeriod)

|

| Straight Line Half Year with Disposal |

Option:IgnoreNetBookValueInMonthOfDisposal |

Case When DisposedThisPeriodFlag = 1 Then ((PeriodsInFy / RecoveryPeriod) * HalfYearFactor * BusinessUseFactor * Basis) - AccumulatedDepreciationThisYear Else (PeriodsInFy / RecoveryPeriod) * HalfYearFactor * BusinessUseFactor * Basis / DepreciablePeriodsInServiceInYear End

|

All financial data is stored in transactions. Each transaction has a transaction type. Some transactions types are fixed and others can be defined by users. Examples of Transaction Types are: Purchases, Depreciation, Disposal, Cost Incurred, Insurance Cost, Routine Maintenance Cost.

Each transaction type has a set of posting rules associated with it. For example, a disposal’s posting rules might say:

DR 1020 – AP Disposals - Cars

CR 1030 – Depreciation

DR 2020 – Depreciation – Cars

CR 3020 – Gain/Loss on disposal

Posting rules can be across the board, specific to a category group or specific to a category.

The depreciation calculation engine will choose the most specific posting rule over any others which apply.

The xAssets period end processing software creates journal files in the format required by your accounting software.

In general, once a journal is posted, reversing it in your accounting system is undesirable. Therefore xAssets depreciation calculations supports catch-up depreciation, so some calculations were incorrect in a period, you can catch up the depreciation in the next month. Catch-up covers the following scenarios: